Accounting Acronyms Debits And Credits

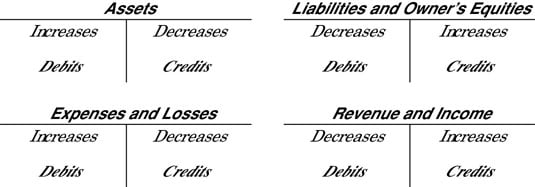

A debit is any transaction or amount that is withdrawn from the company’s balance sheet. It’s easy to remember all of the different types of debit using the mnemonic device DEAL: Draws, Expenses, Assets, and Losses. Draws are any cash that comes out of the business, for example petty cash. Expenses are any static expenditure of money, like rent and payroll. Assets are when a company spends money to buy real property. And losses are when a business loses money for any other reason.CreditCredits are any transaction that results in incoming cash. The mnemonic acronym that accountants use to remember what a credit is is GIRLS: Gains, Income, Revenues, Liabilities, and Shareholders’ equity.

Gains refers to share price gains that the company makes. Income is any other cash that comes into the business which isn’t gains or revenues. Empire total war us marines. Revenues are cash that the business takes in in exchange for goods or services rendered. Liabilities are any amount that the business owes to outside forces, like a loan from a bank.

Accounting Debits And Credits Example

And shareholders’ equity is money put into the business, either by shareholders or the stakeholders in the company.Double-Entry AccountingAlthough double-entry accounting is too large of a subject to get into in-depth in this article, it needs to at least be mentioned when you’re dealing with debit vs credit. In double-entry accounting, a transaction can be one or the other — debit or credit — and often it’s both. For instance, when a company borrows money from a bank it’s entered into two accounts. It’s a credit in the Cash account and a debit in the Notes Payable account.In this way, debits and credits form the core of double-entry accounting, which is the system that most businesses use.

Debits And Credits Asheville

Debits are entered on the left of the balance sheet, while credits are entered on the right-hand side.Debit vs CreditWhen it comes to debit vs credit, it’s easy to tell the difference if you remember the mnemonic acronyms GIRLS for credits and DEAL for debits. Although there are a few tricky areas, like the fact that loans are handled as credits, double-entry accounting makes short work of that problem by adding each line item as a credit in one account and a debit in the other.As long as you keep the mnemonics in mind, and trust in the process of double-entry accounting, you’ll be able to tell credits from debits apart easily on your balance sheet. It’s also important to keep in mind that not all credits are good, and not all debits are bad — the system is more complex than that. Still, if you keep your eye on the numbers and keep a few simple rules in mind, you won’t have any problem telling the difference between debit vs credit.